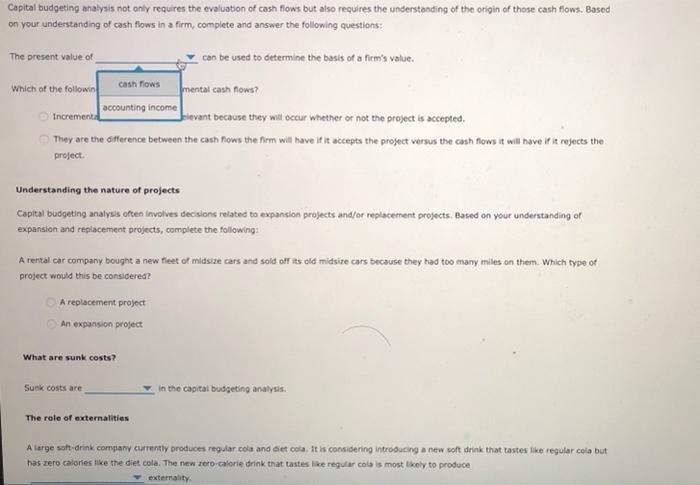

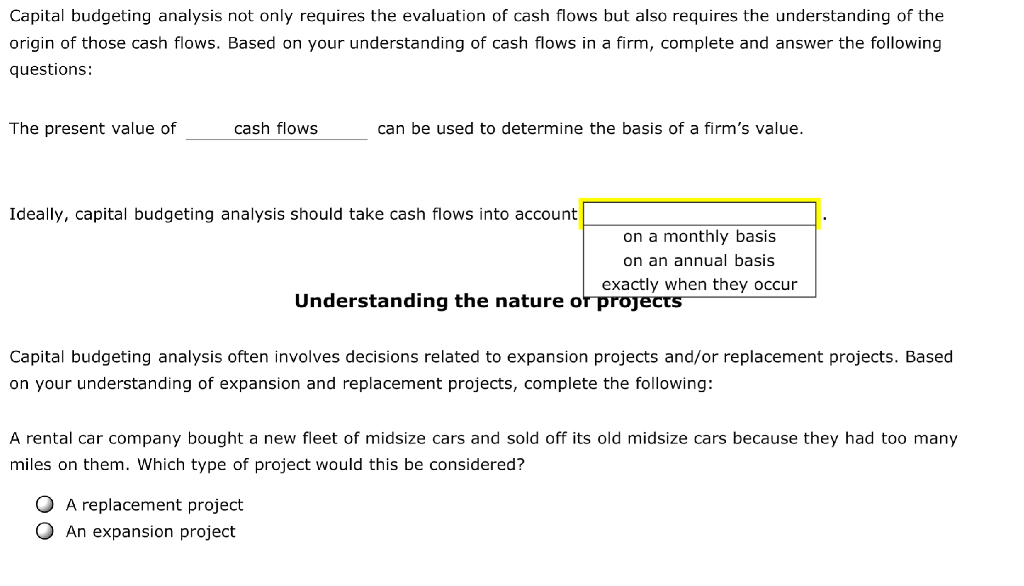

Ideally capital budgeting analysis should take cash flows into account – Ideally, capital budgeting analysis should take cash flows into account. This is because cash flow is the lifeblood of any business. Without a positive cash flow, a business cannot survive. Capital budgeting analysis is the process of evaluating long-term investment opportunities.

It is a critical tool for businesses of all sizes, as it helps them make informed decisions about which projects to invest in.

There are a number of different methods that can be used to estimate cash flows for capital budgeting purposes. The most common method is the discounted cash flow (DCF) method. The DCF method takes into account the time value of money, which is the concept that money today is worth more than money in the future.

The DCF method also takes into account the riskiness of the investment. The higher the risk, the higher the discount rate that should be used.

Types of Cash Flows in Capital Budgeting: Ideally Capital Budgeting Analysis Should Take Cash Flows Into Account

Cash flows play a crucial role in capital budgeting analysis, as they provide a detailed account of the financial impact of an investment project. There are three main types of cash flows considered in capital budgeting:

- Operating Cash Flows:These cash flows arise from the day-to-day operations of a business, such as revenue from sales, cost of goods sold, and operating expenses.

- Investing Cash Flows:These cash flows are associated with the acquisition or disposal of long-term assets, such as the purchase of new equipment or the sale of an old building.

- Financing Cash Flows:These cash flows are related to the financing of the investment project, such as the issuance of debt or the payment of dividends.

These cash flows are used to evaluate investment opportunities by providing a comprehensive view of the project’s financial performance.

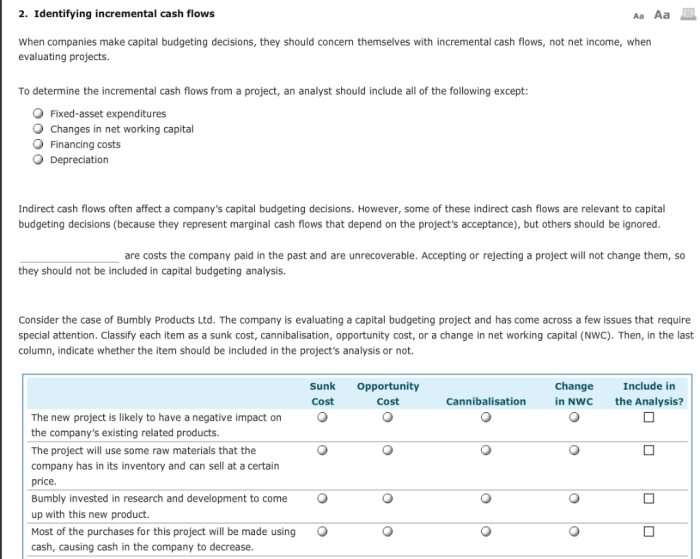

Methods for Estimating Cash Flows

Estimating cash flows for capital budgeting purposes is a critical task that requires careful consideration of various methods. Some of the commonly used methods include:

- Discounted Cash Flow (DCF) Method:This method involves discounting future cash flows back to their present value to determine the net present value (NPV) of the project. NPV is a key metric used to evaluate the profitability of an investment.

- Payback Period Method:This method calculates the period of time required for the project to generate enough cash flows to cover its initial investment. A shorter payback period is generally preferred, as it indicates a faster return on investment.

The choice of method depends on factors such as the nature of the project, the availability of data, and the risk profile of the investment.

Time Value of Money and Discounting, Ideally capital budgeting analysis should take cash flows into account

The concept of the time value of money is fundamental to capital budgeting analysis. It recognizes that money today is worth more than money in the future due to the potential for earning interest or returns. Discounting is a technique used to adjust future cash flows back to their present value to account for this time value.

Common discounting methods include:

- Net Present Value (NPV):NPV is calculated by discounting all future cash flows back to the present using a specified discount rate.

- Internal Rate of Return (IRR):IRR is the discount rate that makes the NPV of a project equal to zero. It represents the rate of return that the project is expected to generate.

Discounting helps in evaluating investment opportunities by providing a more accurate assessment of their profitability and risk.

FAQ Guide

What is capital budgeting?

Capital budgeting is the process of evaluating long-term investment opportunities.

What is cash flow?

Cash flow is the movement of money into and out of a business.

Why is it important to take cash flows into account when making capital budgeting decisions?

Cash flow is the lifeblood of any business. Without a positive cash flow, a business cannot survive.